car sales tax in austin texas

If buying from an individual a motor vehicle sales tax 625 percent on either the purchase price or standard presumptive value whichever is the highest value must be paid when the vehicle. Does Austin have income tax.

Notice Of 2021 Tax Year Proposed Tax Rate For City Of Austin Austintexas Gov

There is a 625 sales tax on the sale of vehicles in Texas.

. In the state of Texas sales tax is legally required to be collected from all tangible physical products being sold to a consumer. The date that you. Local tax rates range from 0 to 2.

This is the total of state county and city sales tax rates. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. Motor vehicle tax is due from the lessee at the time of titling and registration on the purchase of the motor vehicle from the lessor since a new taxable sale second transaction has occurred.

The County sales tax rate is. Sales Tax 625 on the purchase price or Standard Presumptive Value SPV. If purchased from anyone.

How much is sales tax in Texas on a car. Some dealerships may charge a documentary fee of 125 dollars. 5 hours ago How to Calculate Texas Sales Tax on a Car.

Sales tax on a car purchase in Texas is 625 regardless of where you buy it. Get a Kelley Blue Book instant cash offer. Used Cars for Sale in Austin TX.

The make model and year of your vehicle. SPV applies wherever you buy the vehicle in Texas or out of state. The Texas Constitution forbids personal income taxes.

Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the purchase price or standard presumptive. CityCountyother sales tax authorities do not apply. Higher Than Normal Call Volume.

Texas collects a 625 state sales tax rate on the purchase of all vehicles. In addition to taxes car purchases in Texas may be. Used Cars for Sale Austin TX.

Texas Vehicle Sales Tax Fees Calculator Find The Best Car. The vehicle identification number VIN. Pre-qualify for a car loan with no credit score impact.

Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625. TX Sales Tax Rate. Motor vehicle sales tax is due on each retail sale of a motor vehicle in Texas.

An example of items that are exempt from Texas sales tax. The Texas sales tax rate is currently. The minimum combined 2022 sales tax rate for Austin Texas is.

However there may be an extra local or county sales tax added onto the base 625 state tax. 625 on the purchase price if purchased from an authorized dealer. A motor vehicle sale includes installment and credit sales and exchanges for property services or money.

Texas has a 625 statewide sales tax rate but also has 989 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 169 on. To calculate the sales tax on your vehicle find the total sales tax fee. The current total local sales tax rate in Austin TX is.

The information you may need to enter into the tax and tag calculators may include. 6 rows The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and.

Tax Free Weekend In Texas Back To School Shopping Guide Kxan Austin

Photos Lamborghini Opens First Austin Dealership Luxury Cars Line Up On North Lamar Austin Business Journal

Porsche Austin Offers Endless Possibility In The Lone Star State Porsche Newsroom Usa

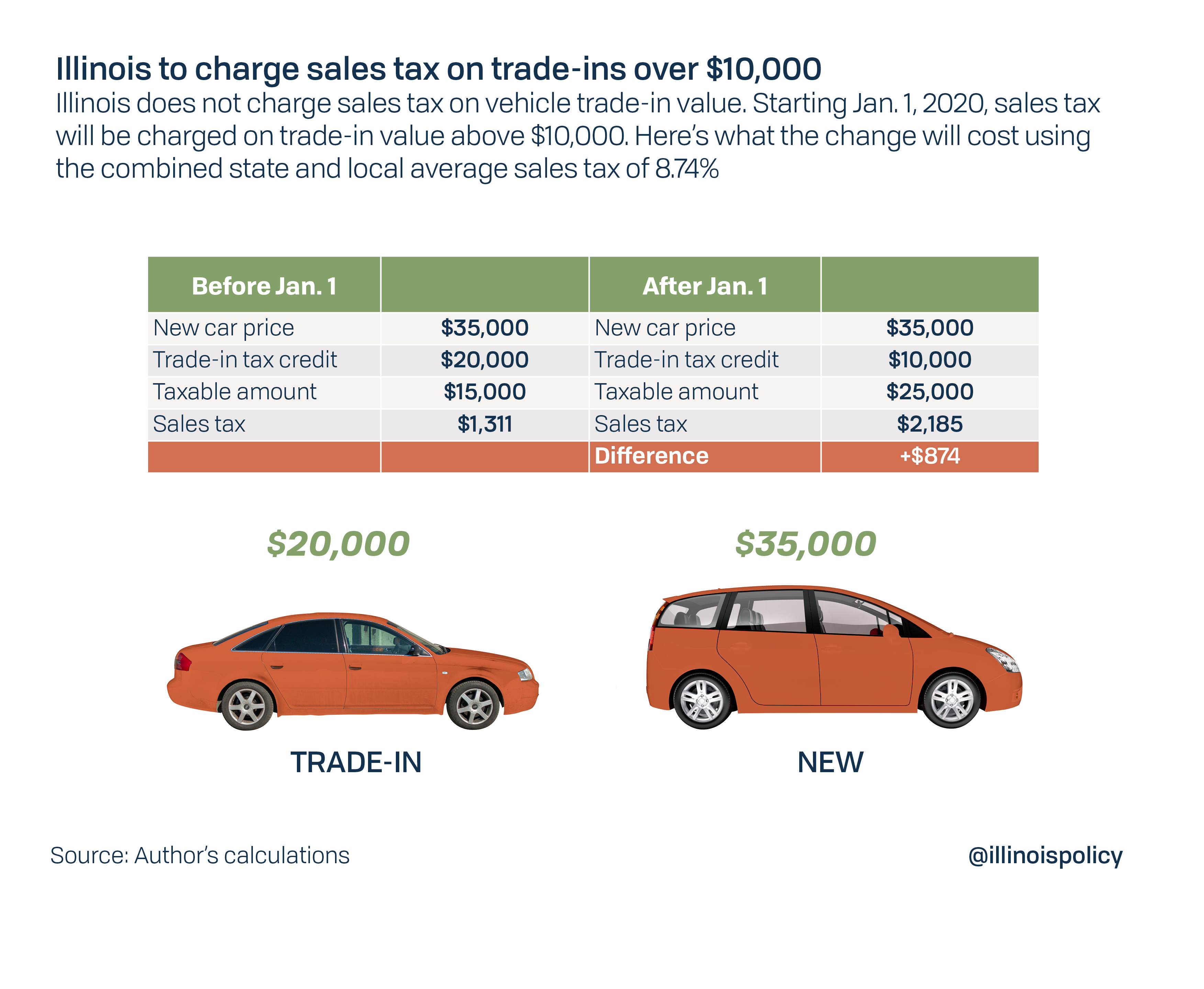

Illinois House Bills Would Reverse Pritzker S Car Trade In Tax

2022 Cost Of Living In Austin Texas Bankrate

Used Cars For Sale In Austin Tx Cars Com

Inside Clean Energy Us Electric Vehicle Sales Soared In First Quarter While Overall Auto Sales Slid Inside Climate News

1206 W 51st St Austin Tx 78756 Mls 5586478 Redfin

Used 2014 Dodge Charger For Sale In Austin Tx Save 10 133 This November Cargurus

Used Cars For Sale In Austin Nyle Maxwell Chrysler Dodge Jeep Ram

Used Pickup Trucks In Austin Tx For Sale

Sales Tax Exemptions Texas Film Commission Texas Film Commission Office Of The Texas Governor Greg Abbott

1804 Miriam Ave Austin Tx 78702 Redfin

Some Labor Is Subject To Sales Tax In Texas

New Chrysler Dodge Jeep Ram Cars Trucks Suvs For Sale Austin Tx

Used Cars For Sale In Austin Nyle Maxwell Chrysler Dodge Jeep Ram